Does Germany have what it takes to build a megaconstellation?

- Oct 3, 2025

- 4 min read

Updated: Oct 7, 2025

October 3, 2025 - Written by Caleb Henry

The blessing and curse of European space policy is the continent’s “do it together” approach. By pooling spending through the European Space Agency and the European Union (two separate entities), Europe can do far more collectively than it can as two dozen separate countries. The tradeoff, however, is that countries must sacrifice some of their individual goals for the sake of the group.

The collective approach worked well for several key projects, like the Copernicus remote sensing fleet, the Galileo navigation constellation, and various space exploration programs (Gaia, Euclid, etc.). But in recent years, it’s grown clear that Germany was feeling hamstrung on national priorities.

On launch, Germany was less enthused than France about subsidizing Ariane 6 and more interested in supporting domestic startups. On the IRIS2 constellation, Germany called the program too expensive, and last year dismissed it as “too French.” And in June, Germany’s DLR gave a tepid response to the pan-European remote sensing constellation, European Resilience from Space (ERS), now in the planning phases.

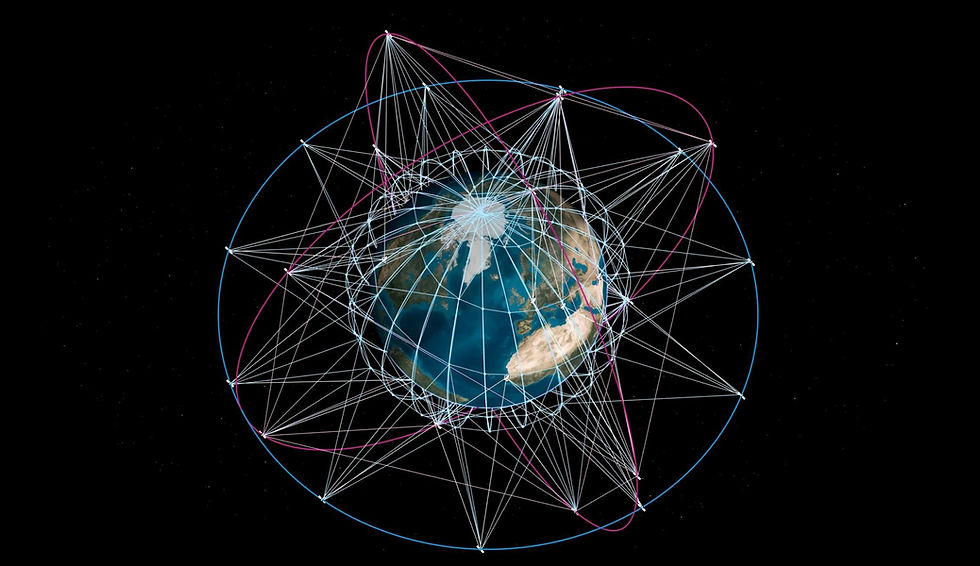

Alongside these fissures, Bundeswehr the German military, started mulling a national constellation of hundreds of satellites, a conversation that spilled into the open in April. Last week, German Defense Minister Boris Pistorius pledged €35B ($41B) through 2030 on an array of military space programs. This was followed by Major General Michael Traut outlining high-level plans for this constellation of hundreds of satellites doing everything from telecom and imaging to RF mapping and missile warning.

The final push for this sovereign constellation was not EU friction, but a strained relationship with the U.S. and Russian aggression on the ground and in orbit. Germany’s surging space spending could radically reshape the country and Europe. Already, Germany is the world’s fourth-largest defense spender, following the U.S., Russia, and China, but space was not a major area of investment. Now, per Handelsblatt, space spending is poised to increase sixfold, adding the equivalent of ESA’s annual budget to Germany’s domestic programs every year for the next five years.

What does this mean for Germany’s space sector? Already, there is a heavy expectation that German companies will be best positioned to benefit from the spending surge. Spacecraft manufacturer OHB’s stock price doubled after Pistorius’s speech. Creating a constellation of the size and scope described by Gen. Traut will impact all elements of the space ecosystem and will illuminate the strengths and weaknesses of Germany’s space sector. How German can the constellation be, and to what extent will the vision depend on the whole of Europe? Quilty Space evaluated the following areas:

Launch. Launching a constellation of hundreds of satellites will require a serious launch effort. This will put pressure on Germany’s emerging small launch providers like Isar Aerospace, HyImpulse and RFA. Germany has several of the world’s premier launch startups, but all are building small rockets with between 500-1,500 kg of capacity to low Earth orbit. For a raft of reasons (cost, cadence, schedule), no megaconstellation has launched on small rockets. Starlink, OneWeb, Amazon, and Telesat all rely on medium or heavy-lift rockets that can deploy satellites by the dozens. This will put pressure on German launch startups to build bigger rockets, and in the near term, positions Arianespace as the key launch provider. Love it or hate it, the Ariane 6 is the only European launch vehicle capable of quickly deploying a constellation (and it doesn’t hurt that the upper stage is built in Germany).

Satellite manufacturing. OHB is skilled at building remote sensing and navigation satellites, but the range of payloads required for the future German constellation will demand more skill sets. Satellite communications is not one of OHB’s strengths, and there are no public German radiofrequency mapping companies, suggesting this is also a new skillset requirement. Infrared missile-warning sensors share some technical heritage with weather satellites, but adaptation is non-trivial. If Germany wants to speedily deploy a multi-purpose constellation, it will have to rely on a whole-of-Europe approach while new competencies are built up domestically. This is also true at the component level. Germany is adept at building optical crosslinks and solar arrays, but it will need to industrialize dozens of components (propulsion, reaction wheels, etc.) if it wants a domestic supply chain that can support a megaconstellation.

Ground segment. Germany is home to some prominent teleports, both independent (Media Broadcast Satellite, IABG, Talia, Horizon) and corporate (SES, ABS, Hispasat), that could anchor a future constellation. Germany is also home to the second-highest number of data centers in the world after the U.S., providing lots of potential host sites for constellation ground infrastructure. The data routing and processing needs of a multi-purpose constellation will be significant, given the large volumes of data generated and the need, especially with missile warning, for low latency. If not done well, this could handicap a constellation, a la GPS-3, MUOS and OneWeb. The leading vendors for ground segment equipment (gateways, not terminals) are in the U.S., Israel, and Spain. Ensuring sovereign ground will require maturing this sector alongside manufacturing and launch.